Statistics for Decision Makers - 33.01 - Forecasting

Jump to navigation

Jump to search

Economists。

There are two types of economists:

- those who don't know how to forecast interest rates

- and those who think they know how to forecast interest rates

What is Forecasting。

- Forecasting is the process of making statements about events whose actual outcomes have not yet been observed.

- Usually related to estimation for some variable of interest at some specified future date

- Prediction is a similar, but more general term

What forecast is not。

- Target

- A description of where we think we are heading, based on current assumptions

- Plan

- A set of future actions designed to reach an objective

- Budget

- A sum of money allocated to an activity or action to which an organization has committed itself

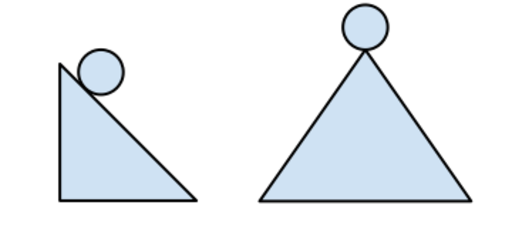

Two kind of Forecasting Models。

- Momentum Forecasting Models

- We can predict, but our action will not change the assumptions of the forecast

- Usually mathematical or statistical models

- E.g. solar activity

- Interventions Forecasting Models

- We try to asses the future in order to make decisions which in turn can usually prevent the forecast from happening

- Most of these forecasts are based on judgement

- There is feedback, i.e. the forecast itself changes the future (e.g. if you don’t change course, you will hit an iceberg)

Cassandra。

Cassandra paradox 。

Don't confuse the Cassandra Paradox with Cassandra Syndrome

- Had the Trojans not ignored Cassandra would her prediction have been correct?

Raise your hand if you think her prediction would have been correct?

Business Point of View。

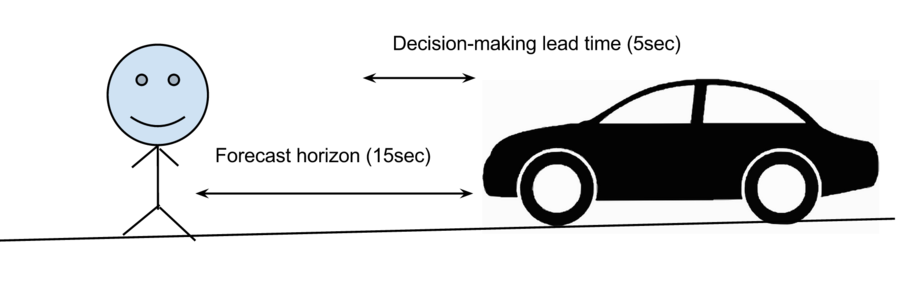

- Decision-making lead time

- The time between taking a decision to do something and the impact being manifested

- Forecast horizon

- The period of time in the future covered by a forecast

- Implications

If the Decision-making lead time is longer than Forecast horizon, do not bother forecasting

Chaos Theory 。

- Deals with dynamical systems that are highly sensitive to initial conditions

- AKA the butterfly effect

- The system can be fully deterministic (as oppose to probabilistic), but can look random

- Managers should recognize the differences between probabilistic, deterministic and chaotic systems

- E.g. organization itself is considered chaotic

Lyapunov time。

- The Lyapunov time is the limit of the predictability of the system

- Examples of the Lyapunov time (without rare events)

- Solar system: 50 million years

- Pluto's orbit: 20 million years

- Organization: from 1 day to hundreds of years

- Scrum Team: 1 day to 30 days

- Hydrodynamic chaotic oscillations: 2 seconds

What is a Model。

- A model is a simplified representation of the world

- Complex models are not usually "better"

Models。

- Mathematical

- E.g. Revenue = Volume * Price

- If we increase speed from 100km/hour to 200km/hour for the train, the travel time will be reduced by 50%

- Statistical

- Regression, Neural Networks, etc...

- People who study 30 mins more per day, with a 95% confidence level, achieve around 20% better results on average

- Judgemental (gut feeling)

- E.g. "I think the recession will last 2 years longer"

- E.g. "Inflation will be around 2% next year"

Some Concepts 。

Risk and Uncertainty

- Risk

- Any deviation from a central forecast where the probability of occurrence can be estimated with a degree of confidence

- Uncertainty

- Any possible deviation from a central forecast where the probability of occurrence cannot be estimated with a degree of confidence

Central vs Range Forecast

- Central forecast

- The "single point" forecast

- Range forecast

- The estimated range of possible outcomes

What to forecast。

Simplest way of forecasting 。

- Important Assumption

- The future will look like the past (no discontinuity happened!)

- Simple mean forecast

- The next customer will spend around £2000 (mean of previous purchases per customer)

- Usually a very big error of forecast (proportional to variance)

- Naive forecast

- Very low error (e.g. stock exchange prices)

- The exchange rate of USD/GBP will be as it was yesterday

Regression model。

A relationship between a dependent variable and one or more independent variables.

E(Y | X) = f(X, β)

- The unknown parameters are denoted as β; this may be a scalar or a vector

- The independent variables, X

- AKA: covariate, explanatory, predictor, control variable

- The dependent variable, Y

Regression Assumptions 。

- The sample is representative of the population for the inference prediction

- The error is a random variable with a mean of zero conditional on the explanatory variables

- The independent variables are measured with no error

- The predictors are linearly independent, i.e. it is not possible to express any predictor as a linear combination of the others. See Multicollinearity.

- The errors are uncorrelated

- The variance of the error is constant across observations (homoscedasticity)

- If not, weighted least squares or other methods might instead be used

Types of Regression 。

- Shape of the function

- Linear

- Non-linear

- Number of predictors

- Simple (one predictor)

- General Multiple Regression

Ordinary Least Square 。

- Finds the line which minimizes squared distance scores from the line

- Uses calculus

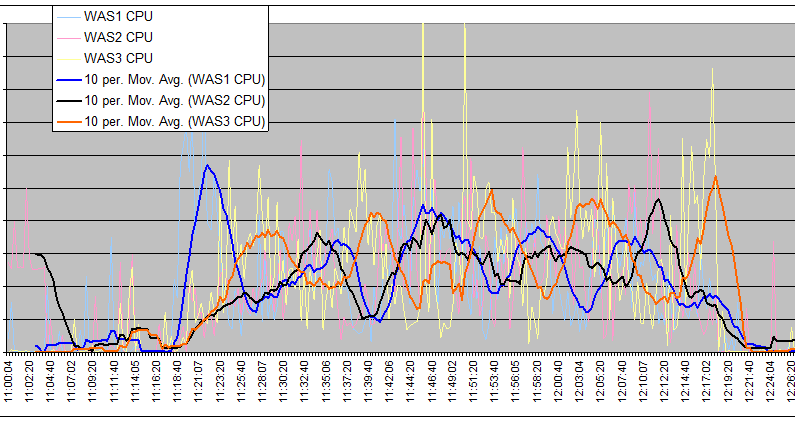

Moving Average 。

The moving average is the plot line connecting all the (fixed) averages

- The moving average smooths the price data to form a trend following the indicators

- They do not predict the price direction, but rather define the current direction with a lag

- Types

- Simple Moving Average (SMA)

- Exponential Moving Average (EMA)

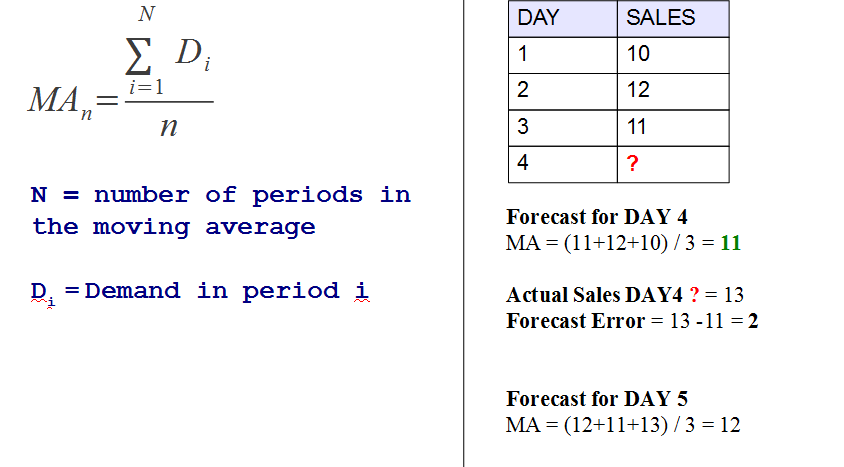

Simple Moving Average (SMA) 。

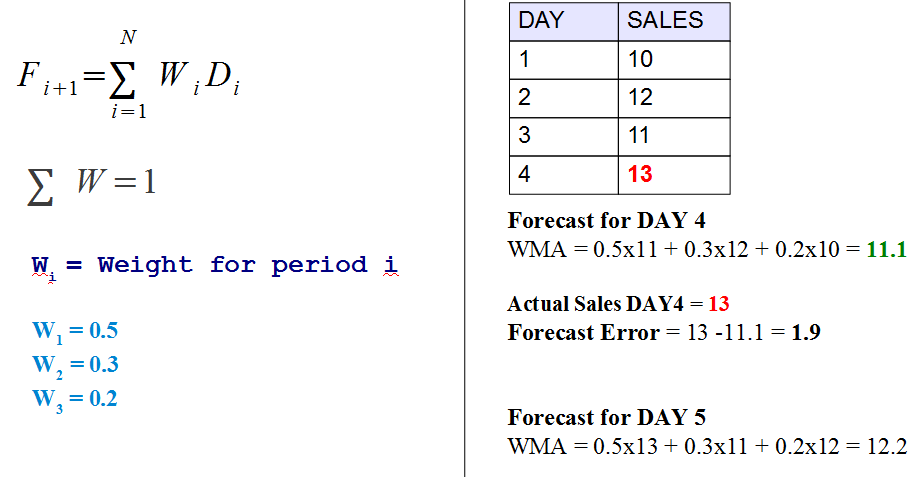

Weighted Moving Average (WMA) 。

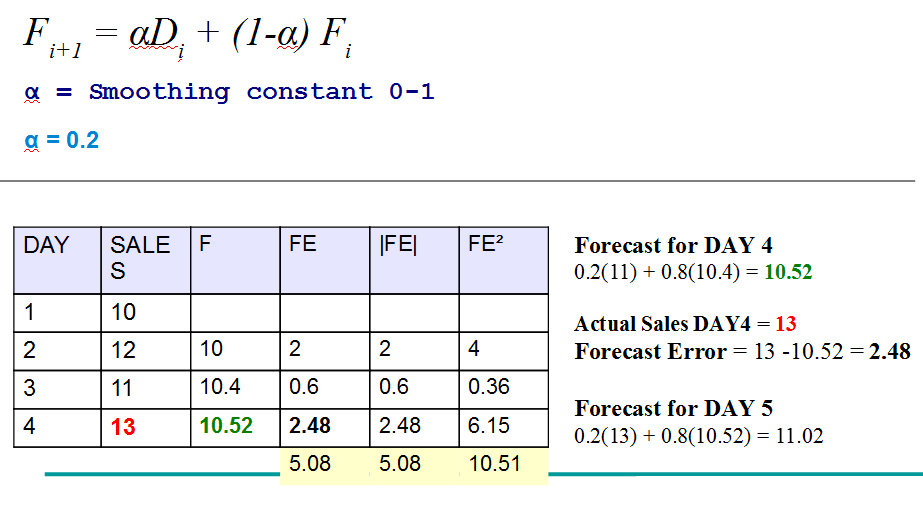

Exponential Smoothing 。

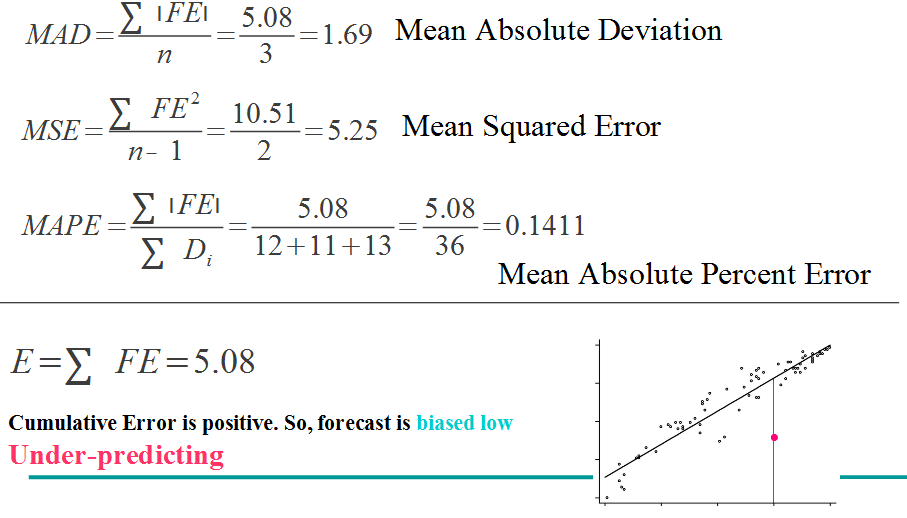

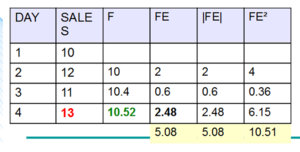

Forecast Error Measures。

Forecast Error Measures 。

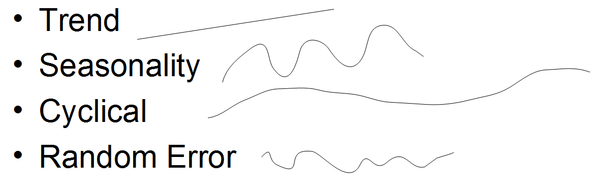

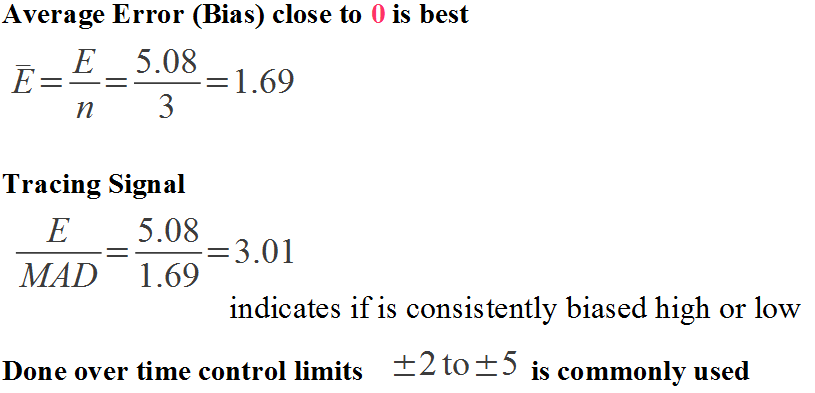

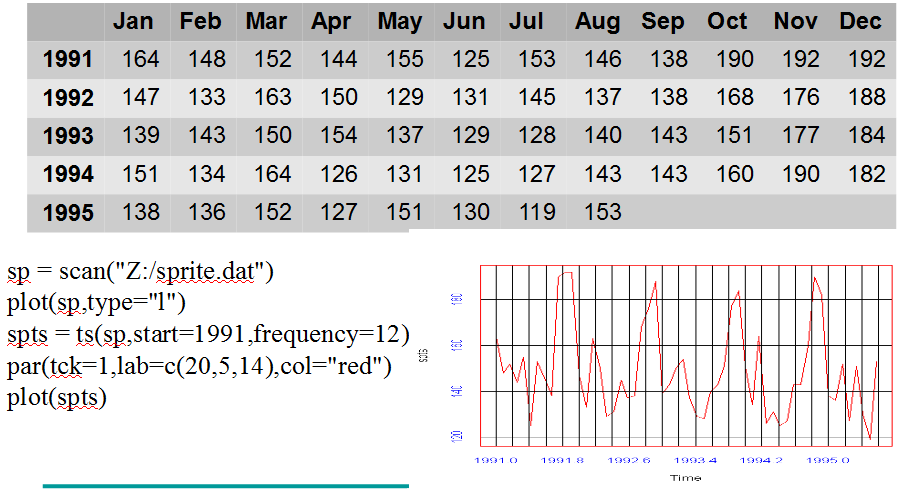

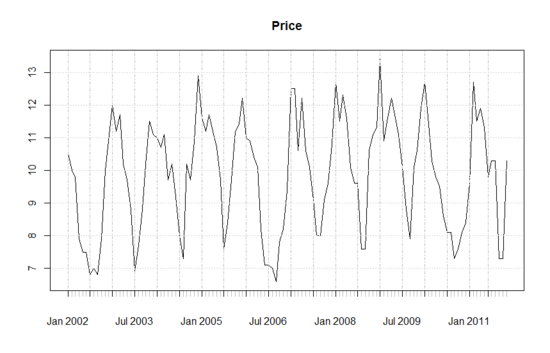

Time Series 。

- The data consist of a systematic pattern (usually a set of identifiable components) and random noise (error)

- Can be described in terms of two basic classes of components: trend and seasonality

Forecasting Exercises - Sprite Sales 。

Code to paste

sp = scan("Z:/sprite.dat")

plot(sp,type="l")

spts = ts(sp,start=1991,frequency=12)

par(tck=1,lab=c(20,5,14),col="red")

plot(spts)

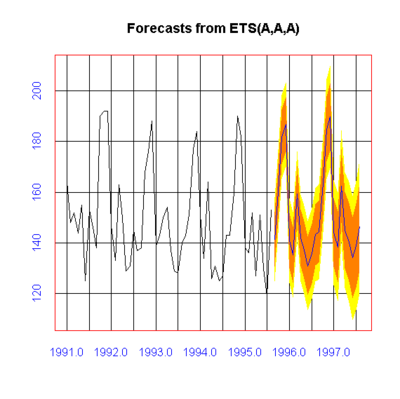

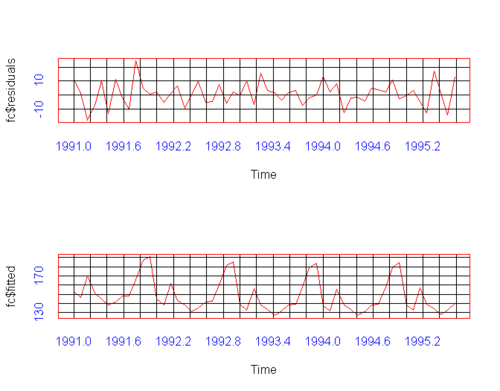

Forecasting ETS。

fc = forecast(spts)

print(fc)

plot(fc)

plot(fc$residuals)

lines(fc$fitted)

What are the sales of Sprite in Jan 1997 going to be? (Give range and point estimation)

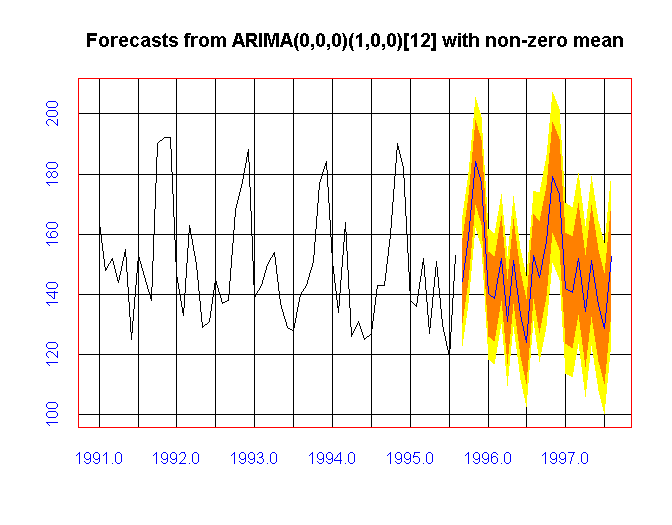

ARIMA (auto)。

ar = auto.arima(spts)

fc = forecast(ar)

plot(fc)

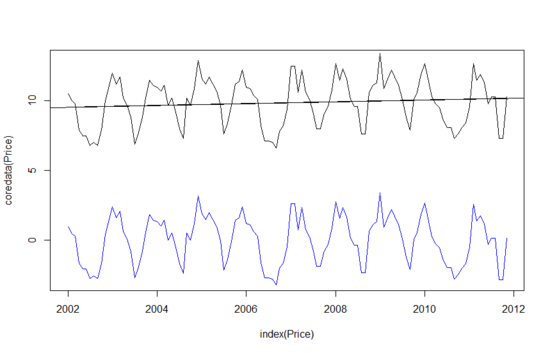

Trend Analysis 。

- Smoothing involves some form of local averaging of data such that the nonsystematic components of individual observations cancel each other out

- The most common technique is moving average (mean or median)

- Fitting a function (usually linear)

Detrending and ensemble methods。

More: R - Time Series

Judgemental Methods。

- Surveys

- Delphi method

- Scenario building

- Technology forecasting

- Forecast by analogy

Combining Models。

- Usually we use all models (Judgemental + Statistical + Mathematical)

- For example, if we want to predict the revenue, we have price and volume

- Price * volume (mathematical model)

- Finding trends and analysis of seasonality (statistical)

- Scenario for growth - trend slope = 0, slope = 0.2, slope = 0.5

- Multiple models can be used and compared which delivers the best results (smallest error or prediction), it is referred to as an ensemble model