R - Forecasting

Approaches to Forecasting

- ARIMA (AutoRegresive Integrated Moving Average)

- ETS (Exponential smoothing state space model)

We will discuss how those methods work and how to use them.

Forecast package overview

# Install Libraries

install.packages("forecast")

library("forecast")

rawdata <- read.table("http://training-course-material.com/images/1/19/Sales-time-series.txt",h=T)

rawdata$Date <- as.Date(rawdata$Date)

head(rawdata)

plot(rawdata)

# Using build in ts object

sts <- ts(rawdata$Sales,start=2001,frequency=12)

plot(sts)

#par(mfrow = c(2, 2))

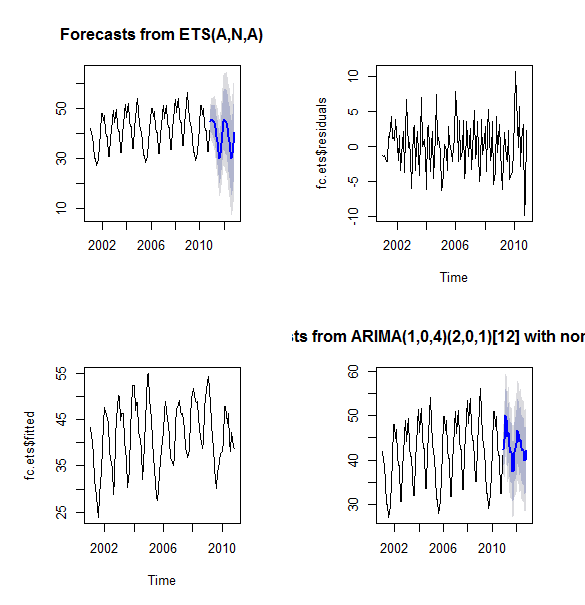

# Forecast using ETS method

fc.ets = forecast(sts)

plot(fc.ets)

plot(fc.ets$residuals)

plot(fc.ets$fitted)

# Forecast using ARIMA method

ar = auto.arima(sts)

ar

fc.arima = forecast(ar)

fc.arima

plot(fc.arima)

accuracy(fc.ets)

accuracy(fc.arima)

Exponential Smoothing

- Names

- AKA: exponentially weighted moving average (EWMA)

- Equivalent to ARIMA (0,1,1) model with no constant term

- Used for

- smoothed data for presentation

- make forecasts

- simple moving average: past observations are weighted equally

- exponential smoothing: assigns exponentially decreasing weights over time

- Formula

- {xt} - raw data sequence

- {st} - output of the exponential smoothing algorithm (estimate of the next value of x)

- α - smoothing factor, 0 < α < 1.

- Choosing right α

- no formal way of choosing α

- statistical technique may be used to optimize the value of α (e.g. OLS)

- the bigger the α the close it gets to naive forecasting (the same ports as original series with one period lag)

Double Exponential Smoothing

- Simple exponential smoothing does not do well when there is a trend (there will be always bias)

- Double exponential smoothing is a group of methods dealing with the problem

Holt-Winters double exponential smoothing

- Input

- {xt} - raw data sequence of observations

- t = 0

- Model

- {st} - smoothed value for time t

- {bt} - best estimate of the trend at time t

And for t > 1 by

where α is the data smoothing factor, 0 < α < 1, and β is the trend smoothing factor, 0 < β < 1.

- Output

- Ft+m - an estimate of the value of x at time t+m, m>0 based on the raw data up to time t

To forecast beyond xt

Triple exponential smoothing

- takes into account seasonal changes as well as trends

- first suggested by Holt's student, Peter Winters, in 1960

- Input

- {xt} - raw data sequence of observations

- t = 0

- L length a cycle of seasonal change

The method calculates:

- a trend line for the data

- seasonal indices that weight the values in the trend line based on where that time point falls in the cycle of length L.

- {st} represents the smoothed value of the constant part for time t.

- {bt} represents the sequence of best estimates of the linear trend that are superimposed on the seasonal changes

- {ct} is the sequence of seasonal correction factors

- ct is the expected proportion of the predicted trend at any time t mod L in the cycle that the observations take on

- To initialize the seasonal indices ct-L there must be at least one complete cycle in the data

The output of the algorithm is again written as Ft+m, an estimate of the value of x at time t+m, m>0 based on the raw data up to time t. Triple exponential smoothing is given by the formulas

where α is the data smoothing factor, 0 < α < 1, β is the trend smoothing factor, 0 < β < 1, and γ is the seasonal change smoothing factor, 0 < γ < 1.

The general formula for the initial trend estimate b0 is:

Setting the initial estimates for the seasonal indices ci for i = 1,2,...,L is a bit more involved. If N is the number of complete cycles present in your data, then:

where

Note that Aj is the average value of x in the jth cycle of your data.

ETS

- Error, Trend, Seasonality

Overriding parameters

rawdata <- read.table("http://training-course-material.com/images/1/19/Sales-time-series.txt",h=T)

rawdata$Date <- as.Date(rawdata$Date)

head(rawdata)

plot(rawdata)

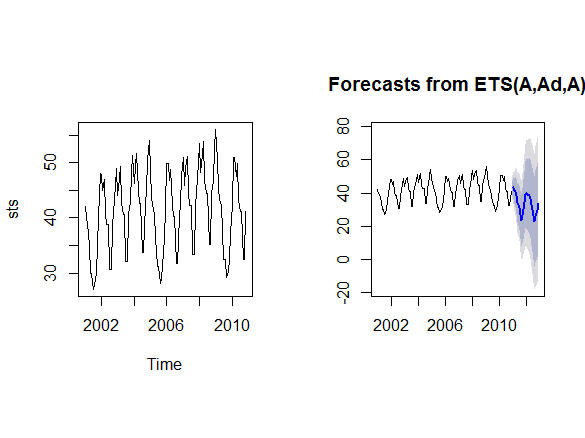

# Using build in ts object

sts <- ts(rawdata$Sales,start=2001,frequency=12)

plot(sts)

# Forecast using ETS method

model.ets = ets(sts,model="ANA")

fc.ets = forecast(model.ets)

model.ets1 = ets(sts,model="AAA",beta=0.2)

fc.ets1 = forecast(model.ets1)

plot(fc.ets1)

accuracy(fc.ets)

accuracy(fc.ets1)